Your 1098-T Form

What is the 1098-T Form?

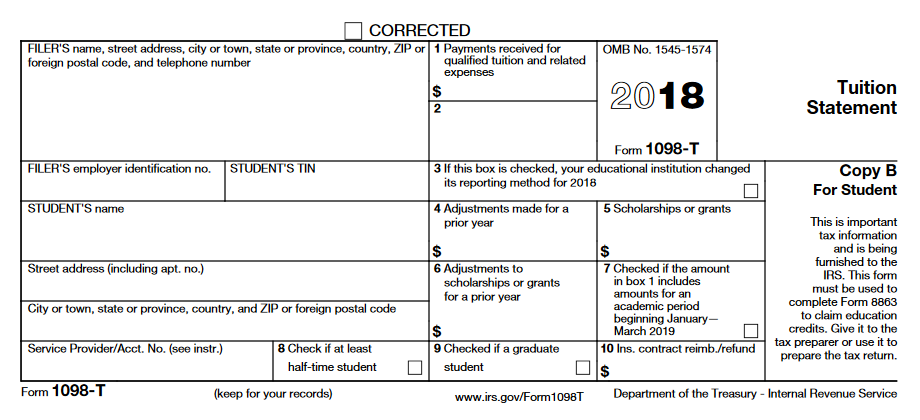

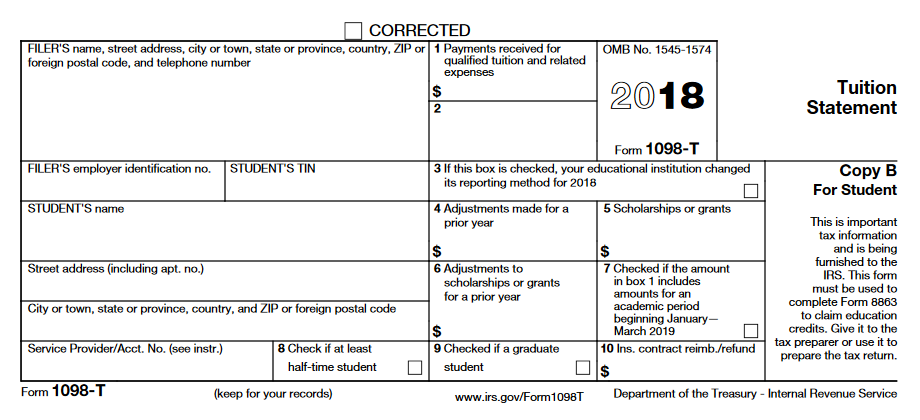

The 1098-T Form contains data elements to help you calculate your eligibility for the American Opportunity Credit (including the Hope Scholarship Credit) and Lifetime Learning Credit. The IRS requires schools to report payments received for qualified tuition and fees during the calendar year. Schools are also required to report scholarships and grants received in Box 5. Receipt of a 1098-T does not automatically establish eligibility for educational tax credits. You should consult a tax advisor to determine your eligibility.

Sample 1098-T Form:

Important Changes to Your 1098-T form starting in 2018:

As of tax year 2018 and due to an IRS change to institutional reporting requirements under federal law, Tufts reports using the Box 1 method which reports the amount of QTRE you paid, including loans, during the year rather than amounts billed. Students who received a 1098-T prior to 2018 when the change happened should be aware of the difference in reporting methods when interpreting their form.

| 2018 Tax Year and Beyond | |

|---|---|

Reported | Amounts paid for qualified tuition and mandatory fees posted to the student account (Box 1) and adjustments made (Box 4) from January 1st through December 31st of calendar year |

Reported | Scholarships and grants received (Box 5) and adjustments (Box 6) from January 1st through December 31st of calendar year |

Not Reported | Room, board, and miscellaneous charges |

Note on Payment Posted Date: The posted date is based on when a payment was applied to the student account. Online payments through eBill are posted in real-time. Payments that are mailed, wired (Flywire), or made through the Cashnet Monthly Payment Plan may take up to a business week to post. To assure these payments are reported in the current tax year, please allow for sufficient processing time. Tufts University is unable to alter or back-date posted dates.

Note on CARES or HEERF Act Grant Funding: If you meet the requirements to receive a 1098-T Form for tax year 2021 and received CARES or HEERF Act funding the value of the grant will not be reported on your form. Other Tufts Emergency Grants will be reported in Box 5 along with any other grants or scholarships received for the year.

Click here to view the IRS FAQs page regarding this grant.

Federal aid (including Federal loans) cannot be posted to the student account until 10 days prior to the first day of the semester. This means that federal aid associated with the spring semester may not be posted until January, and thus will be reported on the subsequent year’s 1098-T.

Tufts cannot provide tax advice and you should consult a tax professional regarding how these changes may impact your tax filing.

How will I receive Form 1098-T?

You will receive IRS form 1098-T electronically if you meet the IRS’ reporting requirements in January. You can download your 1098-T Form at GDIT TRA Services, Inc. If you do not download your form, it will be mailed to your address on record by the end of January. If you have not done so already, please provide your Social Security Number (SSN) or International Tax ID (ITIN) to Tufts prior to the end of the calendar year. Submitting your 1098-T without a SSN or ITIN may result in a fine by the IRS.

If you are an active student then you can find instructions on how to update your SSN/ITIN here. Alumni and students not currently enrolled that attended the Medford and SMFA Campus that includes Arts, Sciences, Engineering, Fletcher, undergraduate and graduate programs please access this link to upload and submit documentation to provide your SSN.

All other Alumni and students not enrolled may print, mail, or fax a W-9 form. Please contact your Registrar’s Office for instructions about where to fax or mail your form. Do not email your SSN/ITIN. Emailed forms will not be accepted.

What information makes up the total in Box 1?

Box 1 contains the net sum of all your applied payments, including loans, during the calendar year that paid for qualified tuition and related expenses for the year. Per IRS guidelines, room and board are not qualified expenses and are not reported in this form.

Why is Box 2 blank on my form?

Box 2 is blank because the IRS eliminated the option of reporting amounts billed. Starting with the 2018 tax year, schools have to report in Box 1 (payments received).

Why is Box 3 checked on my form?

Box 3 shows whether your educational institution changed its reporting method for the tax year. It has changed its method of reporting if the method (payments received) used for the current year is different than the reporting method for the prior year. You should be aware of this change in calculating your education credits. This box will be checked off for tax year 2018 only when our reporting method changed.

What is included in Box 4?

Box 4 is the net sum of any adjustments made to qualified expenses reported in a prior year. If this box is blank then no adjustments were made for the year.

What is included in Box 5?

Box 5 is the sum of all grants and scholarships posted to your account for the calendar year.

What is included in Box 6?

Box 6 is the sum of any reductions made to grants and scholarships reported in a prior year. If this box is blank, no adjustments were made for the year. Please be aware that if your scholarship or grant was replaced by another scholarship and grant, then your Box 6 amount should be deducted from your Box 5 amount. It is possible that Tufts University replaced or swapped a scholarship or grant after it was reported on your prior year 1098-T. In such cases, this swapping may be reported in box 6.

Why did I not receive a form?

If you do not have a qualifying transaction OR if your reportable scholarships or grants are equal to or greater than your total QTRE within the tax year, then you will not receive a 1098-T.

If you are an international student that does not have an ITIN on file with Tufts then you will not get a 1098-T Form. Submitting your 1098-T without a SSN or ITIN may result in a fine by the IRS.

If you are an active student then you can find instructions on how to update your SSN/ITIN here. Alumni and students not currently enrolled that attended the Medford and SMFA Campus that includes Arts, Sciences, Engineering, Fletcher, undergraduate and graduate programs please access this link to upload and submit documentation to provide your SSN.

All other Alumni and students not enrolled may print, mail, or fax a W-9 form. Please contact your Registrar’s Office for instructions about where to fax or mail your form. Do not email your SSN/ITIN. Emailed forms will not be accepted.

All U.S. citizens and permanent residents will be issued a 1098-T if qualifying QTRE payments were made during the calendar year, regardless of whether or not we have your SSN or ITIN.

Am I eligible for a tax credit?

Tufts University cannot provide tax advice. The IRS Home Page is an excellent source for tax information, forms, and advice. The Lifetime Learning Credit and American Opportunity Credit IRS web pages contain important information on frequently asked questions for each tax credit.

More resources about the various credits are available at the GDIT TRA Services Resource Page.